Tax Relief Act 2024 Update Details – one path to diminish their tax obligation is taking part in tax relief initiatives. Administered by the federal government and certain state entities, these programs offer various advantages . In October, Gov. Maura Healey signed a $1 billion tax relief package designed to benefit renters, caregivers, and seniors. The law went into effect when it was signed, but with residents poised to .

Tax Relief Act 2024 Update Details

Source : accountants.intuit.com

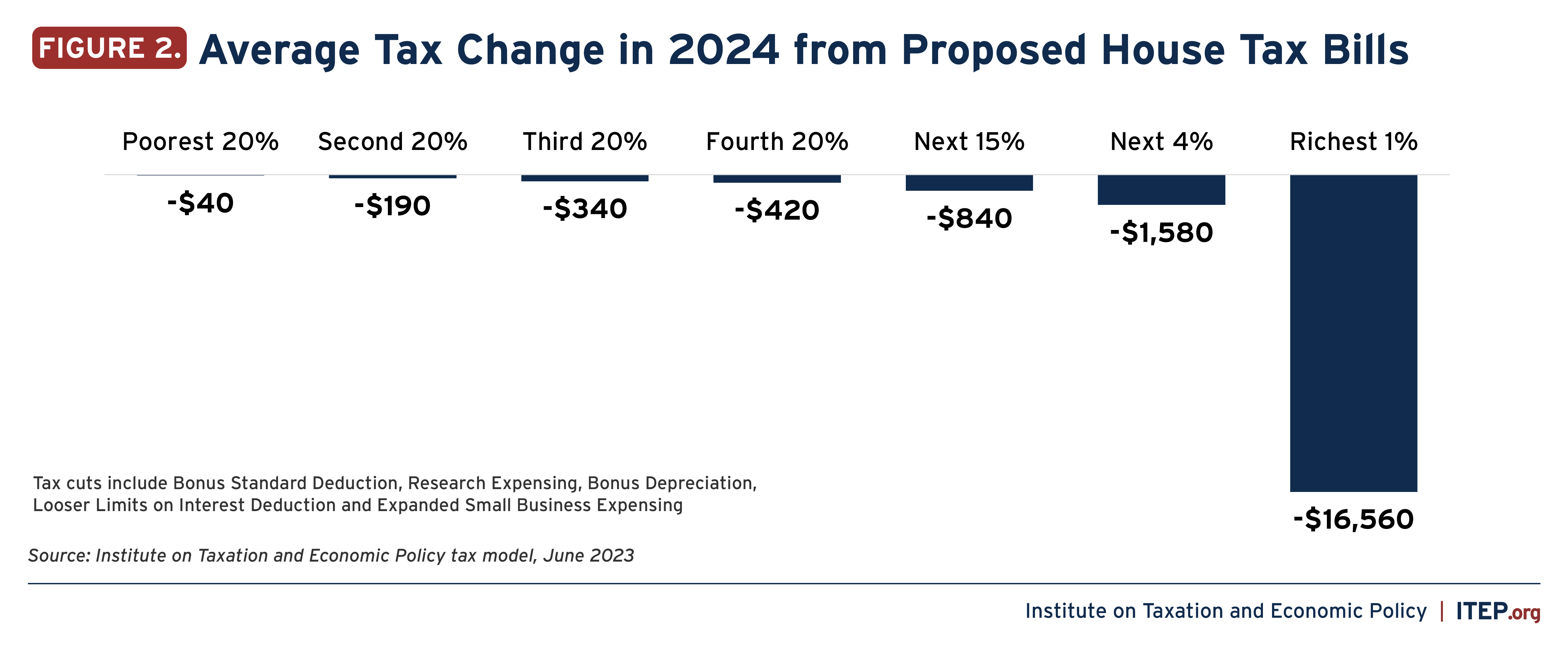

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.org

Hawkins Ash CPAs | La Crosse WI

Source : www.facebook.com

Municipal Priorities | Vermont League of Cities and Towns

Source : www.vlct.org

Lower Your Taxes BIG TIME! 2023 2024: by: Sandy Botkin

Source : redshelf.com

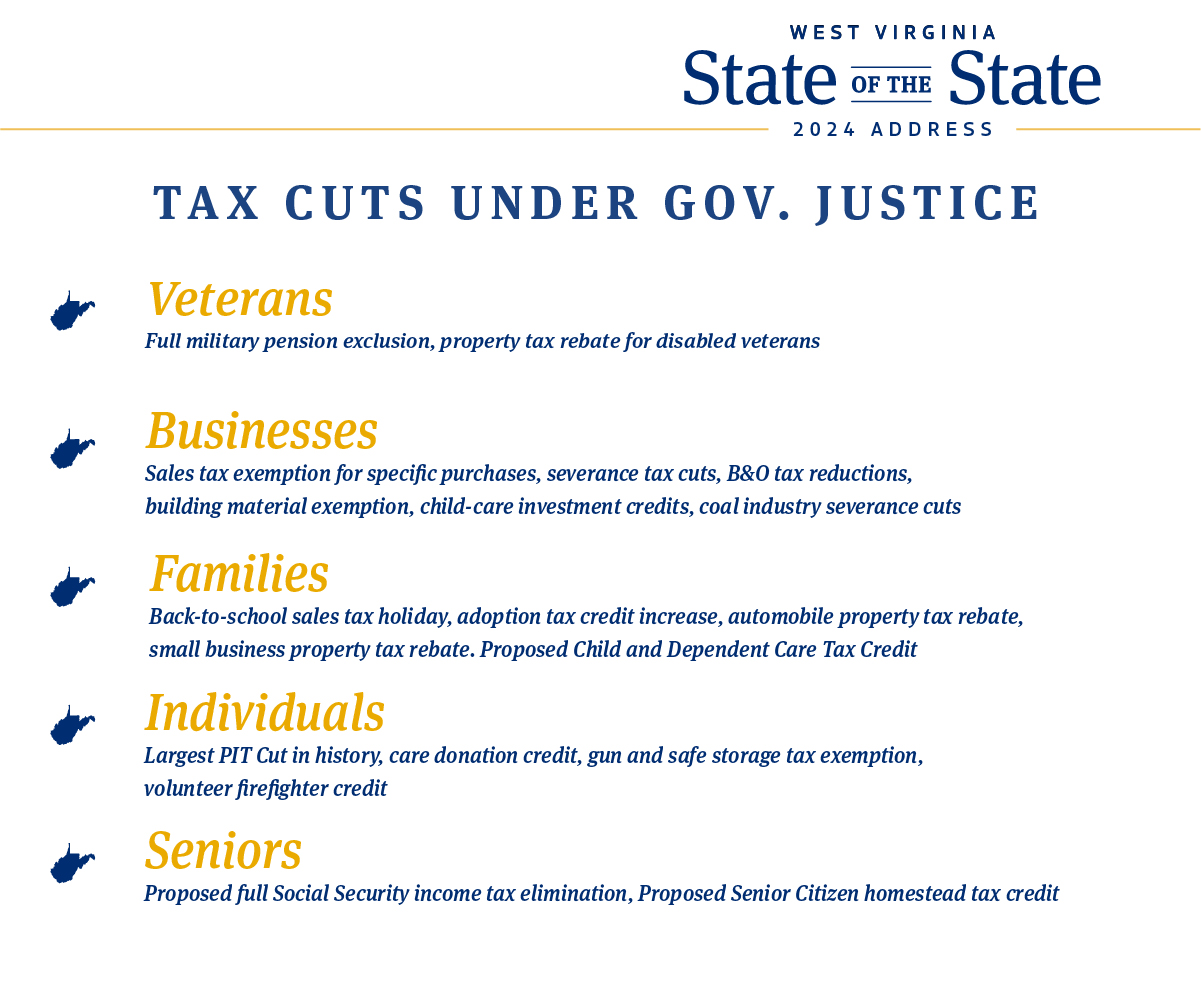

Governor Jim Justice on X: “We’ve cut taxes 23 times since I took

Source : twitter.com

Section 179 Tax Deduction for 2024 | Section179.Org

Source : www.section179.org

Irish Farmers Handbook | Carrick on Suir

Source : m.facebook.com

Tax Season 2024: What You Need to Know Ramsey

Source : www.ramseysolutions.com

Business Tax Renewal Instructions | Los Angeles Office of Finance

Source : finance.lacity.gov

Tax Relief Act 2024 Update Details Tax Pro Center | Intuit | Tax Pro Center: This content was provided by our sponsor, General Fanager. The FOX editorial team was not involved in the creation of this content. Dealing with a colossal tax obligation can be an immense stress . this Federal Tax Update highlights estate planning-related federal tax information that may be helpful as you consider planning options for 2024. Because Congress could pass legislation that .