2024 Tax Brackets Calculator – That’s because the IRS adjusted many of its provisions in 2023 for inflation, pushing the standard deduction to a more generous level and raising its tax brackets by 7.1% other data into a 2024 . Tax brackets are progressive, which means you pay more when you The best free tax software makes it easy to calculate your tax bill and find out what tax credits and deductions you qualify for. .

2024 Tax Brackets Calculator

Source : www.forbes.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Federal Tax Income Brackets For 2023 And 2024

Source : thecollegeinvestor.com

Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®

Source : www.hrblock.com

How Tax Brackets Work [2024 Tax Brackets] | White Coat Investor

Source : www.whitecoatinvestor.com

Free Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet

Source : www.nerdwallet.com

2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet

Source : www.nerdwallet.com

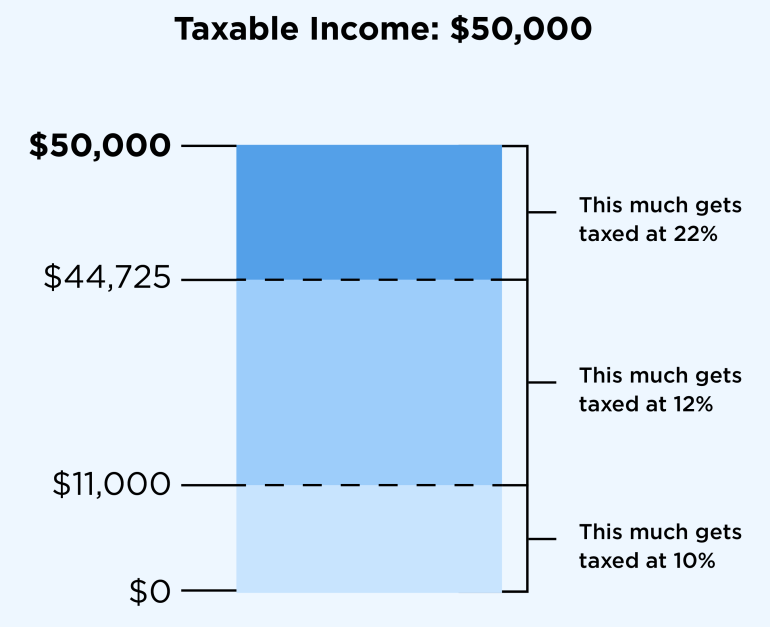

2024 Tax Brackets Calculator Your First Look At 2024 Tax Rates: Projected Brackets, Standard : There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. . Like the tax brackets, the standard deduction increases as “a separate tax system that requires some taxpayers to calculate their tax liability twice—first, under ordinary income tax rules, then .